Right here are the principal kinds of protection that your policy may consist of: The minimum coverage for physical injury varies by state and may be as low as$10,000 per individual or$ 20,000 per accident. If you wound somebody with your vehicle, you can be filed a claim against for a lot of money.

If you have a million-dollar home, you might shed it in a legal action if your insurance policy coverage wants - liability. You can obtain added protection with an Individual Umbrella or Individual Excess Liability policy. The better the value of your properties, the more you stand to shed, so you need to get responsibility insurance coverage appropriate to the value of your possessions. You don't have to figure out just how much to purchase that relies on the automobile (s) you insure. But you do need to determine whether to purchase it and also exactly how big an insurance deductible to take. The greater the insurance deductible, the lower your premium will certainly be. Deductibles typically range from$250 to$1,000. If the vehicle is just worth$1,000.

as well as the insurance deductible is$500, it might not make sense to purchase accident coverage. Crash insurance coverage is not normally called for by state legislation. Covers the price of assorted damages to your vehicle not brought on by an accident, such as fire and theft. As with Accident coverage, you need to select an insurance deductible. Comprehensive insurance coverage is normally marketed along with Accident, as well as both are commonly described together as Physical Damages coverage. If the vehicle is leased or financed, the renting business or lender may need you to have Physical Damages coverage, although the state legislation may not need it. Covers the cost of clinical treatment for you and also

your travelers in case of a mishap. For that reason, if you pick a$2,000 Medical Expense Limit, each traveler will certainly have up to $2,000 protection for clinical cases resulting from a crash in your lorry. If you are involved in a crash and the various other vehicle driver is at fault but has insufficient or no insurance, this covers the space between your prices and the other motorist's coverage, approximately the limitations of your - cheap car insurance.

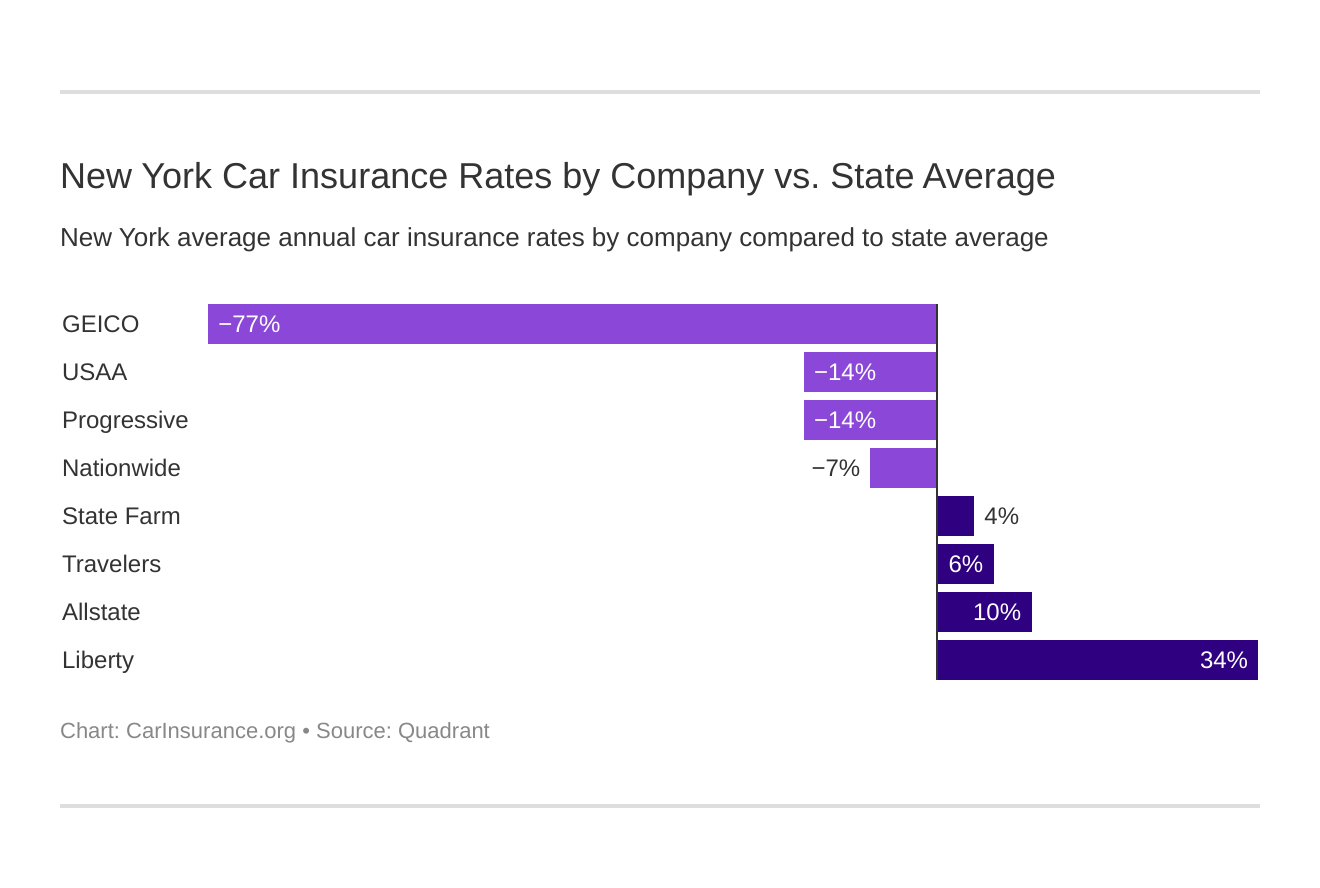

insurance coverage. The restrictions required and also optional restrictions that may be readily available are set by state law. This protection, needed by regulation in some states, covers your clinical costs and those of your guests, no matter that was in charge of the accident. The limits needed as well as optional limits that might be offered are established by state law. In this write-up, we'll explore exactly how average vehicle insurance coverage prices by age and state can rise and fall. We'll additionally have a look at which of the most effective cars and truck insurance coverage companies use good discount rates on car insurance coverage by age and also contrast them side-by-side. Whenever you purchase cars and truck insurance coverage, we recommend obtaining quotes from multiple providers so you can compare insurance coverage as well as rates. So why do typical automobile insurance policy prices by age differ a lot? Primarily, it's all about danger. According to the Centers for Disease Control as well as Prevention (CDC ), individuals in between the ages of 15 and also 19 made up 6. 5 percent of the population in 2017 but represented 8 percent of the complete expense of automobile mishap injuries. The rate data originates from the AAA Structure for Website Traffic Security, as well as it makes up any kind of crash that was reported to the cops . The average costs information originates from the Zebra's State of Vehicle Insurance record. The rates are for plans with 50/100/50 responsibility coverage restrictions and also a$500 insurance deductible for comprehensive as well as crash coverage. According to the National Freeway Traffic Security Management, 85-year-old guys are 40 percent extra likely to get involved in an accident than 75-year-old guys. Considering the table over, you can see that there is a straight connection between the accident price for an age group which age's average insurance policy premium. Bear in mind, you could discover much better rates with one more firm that doesn't have a certain student or elderly discount. * The Hartford is only readily available to participants of the American Association of Retired Persons(AARP). Insurance policy holders can add more youthful motorists to their plan and obtain discounts. Typical Car Insurance Policy Rates And Cheapest Carrier In Each State Due to the fact that automobile protection rates differ a lot from one state to another, the service provider that offers the least expensive auto insurance in one state may not use the most affordable coverage in your state. You'll likewise see the ordinary price of insurance coverage because state to help you compare. The table additionally includes rates for Washington, D.C. These rate estimates put on 35-year-old vehicle drivers with good driving records and credit report. As you can see, ordinary car insurance coverage costs differ commonly by state. insurance. Idahoans pay the least for automobile insurance, while drivers in Michigan pay out the huge bucks for coverage. If you stay in downtown Des Moines, your premium will probably be more than the state average. On the various other hand, if you reside in upstate New york city, your car insurance coverage policy will likely set you back much less than the state standard. Within states, auto insurance costs can vary widely city by city. Yet, the state isn't among the most pricey overall. Minimum Protection Needs The majority of states have financial obligation laws that call for vehicle drivers to lug minimum car insurance coverage. You can just do away with coverage in two states Virginia as well as New Hampshire yet you are still economically in charge of the damages that you cause. No-fault states consist of: What Various other Elements Affect Vehicle Insurance Coverage Rates? Your age and also your house state aren't the only things that affect your rates. Insurance companies use a range of elements to determine the cost of your premiums. Below are several of the most crucial ones: If you have a clean driving document, you'll locate better prices than if you've had any kind of recent crashes or traffic offenses like speeding tickets.

How Much Is Insurance For A New Car? for Dummies

The price of collision coverage is based on the value of your automobile, and it usually features a insurance deductible of $250 to $1,000 (laws). If your automobile would certainly set you back $20,000 to change, you 'd pay the initial $250 to $1,000, depending on the deductible you picked when you purchased your plan, and the insurance firm would certainly be responsible for as much as $19,000 to $19,750 after that (vehicle).

cheapest auto insurance cheapest car accident auto

cheapest auto insurance cheapest car accident auto

Between the price of your yearly costs and also the insurance deductible you 'd need to pay out of pocket after an accident, you might be paying a great deal for really little protection - affordable auto insurance. Even insurance business will inform you that dropping crash insurance coverage makes sense when your automobile is worth much less than a couple of thousand dollars.

As with extensive insurance coverage, states don't require you to have collision insurance coverage, however if you have an auto funding or lease, your loan provider might require it. And also again, when you've paid off your car loan or returned your rented vehicle, you can go down the insurance coverage.

You'll also intend to take into consideration exactly how much your vehicle deserves contrasted with the cost of covering it time after time. Uninsured/Underinsured Vehicle Driver Protection Simply because state legislations require motorists to have liability insurance coverage, that doesn't imply every chauffeur does. As of 2019, an approximated 12. 6% of driversor concerning one in eightwere uninsured.

credit score accident cheapest car insurance prices

credit score accident cheapest car insurance prices

It can cover you as well as household members if you're wounded or your cars and truck is damaged by a without insurance, underinsured, or hit-and-run driver. Some states call for motorists to lug without insurance motorist coverage (UM).

How Much Is Insurance For A New Car? for Beginners

If your state calls for uninsured/underinsured vehicle driver coverage, you can acquire even more than the called for amount if you want to. You can likewise get this insurance coverage in some states that do not require it - cheap car. If you aren't required to purchase uninsured/underinsured driver coverage, you might intend to consider it if the insurance coverage you already have would want to foot the bill if you're associated with a serious mishap.

Various Other Types of Insurance coverage When you're shopping for auto insurance, you might see some other, totally optional kinds of insurance coverage. Those can include:, such as towing, if you need to lease an automobile while your own is being fixed, which covers any distinction between your car's money worth Click here to find out more and what you still owe on a lease or funding if your vehicle is a failure Whether you need any of those will certainly depend on what various other resources you have (such as membership in a car club) and how much you might afford to pay out of pocket if you must.

Whether to purchase greater than the minimum called for protection and also which optional kinds of protection to take into consideration will certainly depend upon the assets you require to secure in addition to exactly how much you can manage to pay (trucks). Your state's car department internet site should explain its needs and may offer other suggestions specific to your state. insurance companies.

Having the ideal info in hand can make it easier to get an accurate automobile insurance coverage quote. car insured. You'll want to have: Your driver's license number Your car identification number (VIN) The physical address where your automobile will be kept You might additionally want to do a little research study on the kinds of coverages readily available to you (laws).

Insurance coverage carriers wish to see shown responsible behavior, which is why website traffic crashes and citations are consider identifying car insurance rates. Bear in mind that aims on your permit don't stay there forever, however how much time they remain on your driving record varies relying on the state you reside in as well as the severity of the offense (cars).

Top Guidelines Of Wells Fargo Bank - Financial Services & Online Banking

A new sporting activities cars and truck will likely be a lot more pricey than, say, a five-year-old sedan. If you select a reduced deductible, it will cause a higher insurance policy bill that makes choosing a greater insurance deductible look like a quite good deal - cheap. However, a higher deductible might suggest paying even more expense in case of a mishap.

What is the typical car insurance expense? There are a broad range of elements that influence just how much automobile insurance policy costs, that makes it difficult to obtain an exact concept of what the typical individual spends for auto insurance policy - auto insurance. According to the American Automobile Association (AAA), the typical expense to guarantee a sedan in 2016 was $1222 a year, or around $102 monthly (insurance companies).

cheaper car insurance cheaper cars cheaper credit score

cheaper car insurance cheaper cars cheaper credit score

Exactly how do I get auto insurance? Obtaining a vehicle insurance policy estimate from Nationwide has actually never been less complicated.