If you move to Florida from another state, ask your insurance agent if your firm creates in Florida (most do) and to transfer your insurance policy to Florida. You can seek out insurance business accredited to do company in Florida at the company directory site on the Florida Workplace of Insurance Policy Guideline - auto.

The registration cost is $225. To register your automobile: If you only reside in Florida throughout the winter season, you still need to maintain a valid auto insurance plan active. The state needs any type of car with a Sunshine State certificate plate and also registration to be covered by a Florida insurance coverage.

Some car insurance provider in Florida offer you with seasonal protection be sure to ask your insurance coverage provider regarding it. If you have a Florida chauffeur's License as well as you're 55 or older, you might finish a six-hour automobile accident avoidance training course. You can take the program online. As long as the completed course is acknowledged by the Florida Department of Highway Safety and also Motor Vehicles, you'll be eligible to obtain a price cut on your auto insurance coverage, helpful for three years.

m. and also 11 p. m. When you're 17, you can drive in between 5 a. m. and 1 a. m. When you turn 18, all restrictions are removed.

Some Known Details About Esurance Car Insurance Quotes & More

Vehicle Insurance Policy Quotes in Florida Are you looking for cost effective car insurance in Florida? Maybe you have actually been a resident of the Sunshine State for some time and also are merely seeking a much better or even more affordable vehicle plan. Every chauffeur in Florida needs vehicle insurance policy coverage. See why numerous insurance holders trust fund GEICO to offer remarkable auto insurance policy from responsibility security to detailed coverage.

We make it simple for you to obtain a cost-free Florida cars and truck insurance coverage quote online. Required Auto Insurance Coverage Protection in Florida Drivers need to make sure they have the vehicle insurance coverage coverages called for by the state of Florida to lawfully operate an electric motor lorry: These are the minimum Florida auto insurance coverage requirements, yet you ought to choose the protection you require.

requires all motorists to bring Accident Security (PIP). This protection assists pay the insured's clinical expenses in case of a mishap, despite mistake. Individuals usually think drivers can not be legally gone after for injuries they cause in a mishap because Florida is a No-Fault state, however that isn't right.

For the initial 90 days with a learner's license, a teen may only drive throughout daytime hrs. An accredited motorist over the age of 21 should always go along with the teenager motorist. > What Is The Least Expensive Car Insurance Policy in Florida for 2022?

Automobile Insurance Coverage in Florida Whether you just moved to the Sunshine State or are looking for brand-new car insurance coverage in Florida, you can trust The Hartford to be there when you require us most. With the AARP Vehicle Insurance Program from The Hartford,1 you can have satisfaction as you drive.

If you're looking to obtain a quote from an insurance provider or need information concerning purchasing vehicle insurance policy in Florida, you have actually come to the appropriate location - car. Automobile Insurance Coverage Quotes for Florida Drivers Getting an auto insurance policy quote in Florida from The Hartford is so very easy that you can do it in minutes.

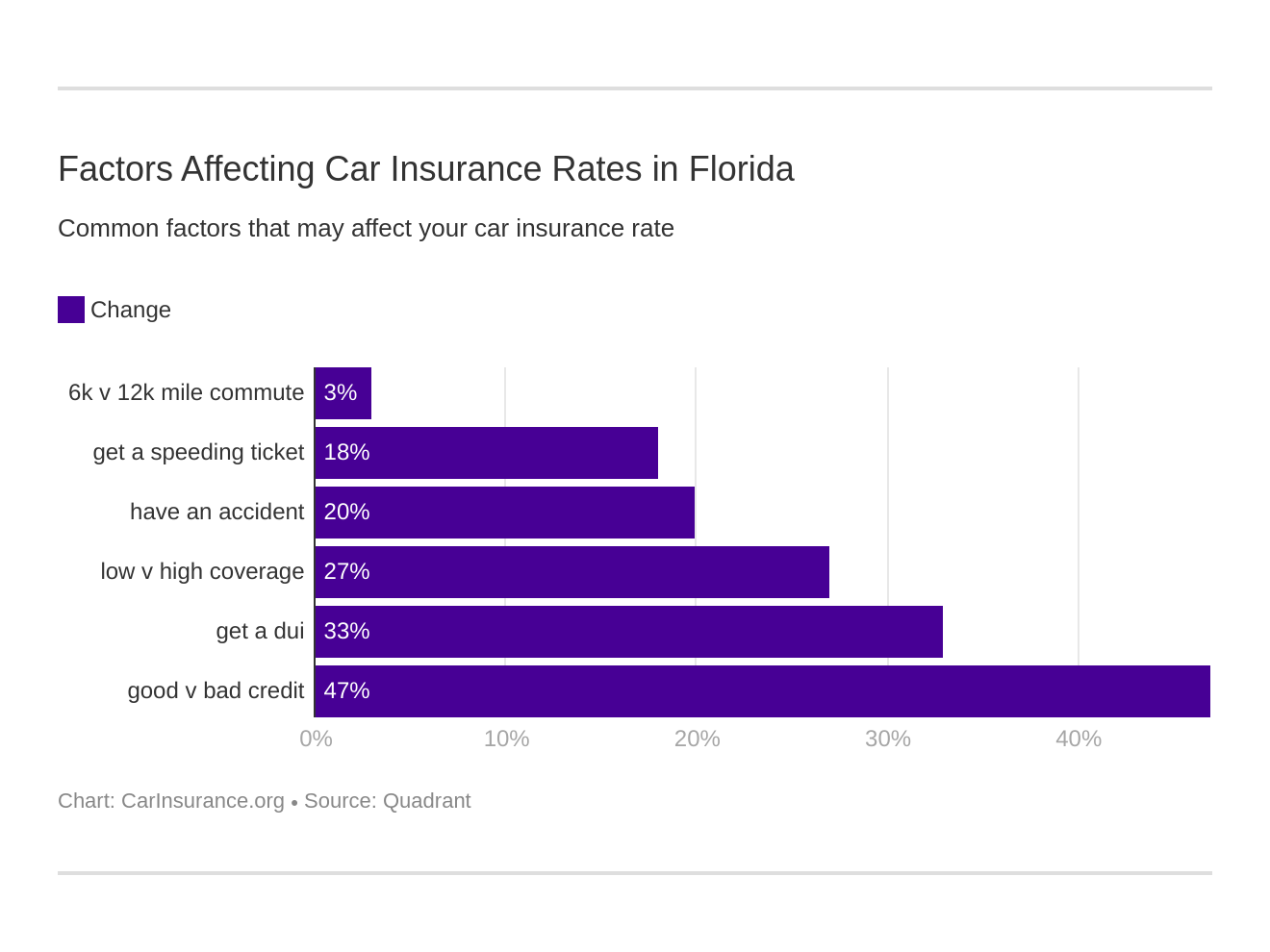

What is the Typical Automobile Insurance Policy Price Per Month in Florida? According to the Insurance Coverage Info Institute, the 2018 typical yearly price for auto insurance coverage in Florida was $1,426, averaging to be about $120 per month - car insured. Car insurance coverage prices in Florida will certainly vary depending on points like your credit report, car mishap background and the amount of insurance coverage needed.

The 30-Second Trick For Florida Car Insurance Information - Quoteinspector.com

Florida Cars And Truck Insurance Rules As a Florida local, you are called for by legislation to have car insurance coverage. If you don't have automobile insurance policy in Florida, you can be fined. There are a variety of secure driving laws indicated to protect you on Florida's roads. Here are just a few:3 Florida Safety Belt Regulation It is obligatory to wear a safety belt while driving in Florida. insured car.

Florida Distracted Driving Regulations Distracted driving is anything that takes your eyes off the roadway or your hands off the wheel, like texting while driving, which is prohibited for all vehicle drivers in Florida. Florida Teen Driver Laws Florida has actually implemented finished licensing regulations to guarantee that teens gain the experience they need to be safe behind the wheel - car insurance.

The Financial Responsibility Legislation Based upon your driving record, you might be called for to lug full obligation auto insurance coverage in Florida - dui. full protection might be required if you have actually created an auto accident where somebody had a covered injury or if you have actually received too much points on your license.

Florida is the 4th most pricey state in America to purchase automobile insurance policy, according to the Insurance Information Institute. Auto insurance policy rates differ for motorists as well as are developed by insurance firms in Florida.

Indicators on Florida Blue: Florida Health Insurance Plans You Need To Know

If you have an at-fault cars and truck accident, your insurance coverage price might be greater. What Is the Minimum Car Insurance Policy Coverage in Florida?

Exactly How Much Is Florida Cars And Truck Insurance Policy? The average price of auto insurance in Florida is concerning $118 per month.

Any kind of vehicle with a current Florida registration must: be guaranteed with PIP and also PDL insurance at the time of lorry registration. have a Cars signed up as taxis must carry bodily injury obligation (BIL) insurance coverage of $125,000 each, $250,000 per occurrence and $50,000 for (PDL) insurance coverage. have continuous insurance coverage even if the vehicle is not being driven or is unusable.

You must obtain the registration certification as well as certificate plate within 10 days after starting work or registration - insurers. You need to additionally have a Florida certificate of title for your vehicle unless an out-of-state lien holder/lessor holds the title as well as will not launch it to Florida. Vacating State Do not terminate your Florida insurance policy till you have actually registered your car(s) in the various other state or have surrendered all legitimate plates/registrations to a Florida.

What Does Florida Car Insurance: Fl Auto Insurance Quote - Progressive Do?

Fines You must preserve necessary insurance coverage throughout the enrollment period or your driving privilege and also license plate might be suspended for up to three years. There are no stipulations for a short-lived or challenge driver license for insurance-related suspensions. Failing to preserve needed insurance protection in Florida may lead to the suspension of your motorist license/registration and a demand to pay a reinstatement cost of approximately $500.

happens when an at-fault celebration is filed a claim against in a civil court for damages triggered in a car accident and also has not pleased residential or commercial property damages and/or bodily injury requirements. (PIP) covers you regardless of whether you are at-fault in a crash, up to the restrictions of your policy. (PDL) spends for the damage to other individuals's property (car insurance).

Overall average annual expense measures what Florida drivers actually invested on vehicle insurance in 2018. These averages may not be what you see in your area. Many individuals understand that the county they live in matters, however costs can even vary in between postal code. Miami is just one of the most costly areas to live, while country areas as well as middle-class suburbs have a tendency to be the most inexpensive.

State Ranch supplies the most inexpensive complete coverage insurance for drivers in Florida with a mishap on their record at an annual price estimate of A speeding ticket is one of several traffic infractions that will certainly trigger your costs to jump. In Florida, the typical estimate for vehicle drivers with a speeding ticket is for a complete protection policy.

The Ultimate Guide To Understanding Commercial Auto Insurance In Florida

Sure, we all wish to save money, however the price can't be the only factor. You can go with the least expensive car insurance policy in Florida, yet will your cases be paid quickly? That's why we review car insurance coverage by different aspects, looking at things like average cost, financial strength, J.D (cheaper auto insurance).

Pros Cons Cost effective prices and many discounts Only available for armed forces as well as their families Great choice for armed forces participants Superior economic strength score and A+ rating from the Better Service Bureau (BBB) To read more concerning the car insurance coverage service provider, look into our full evaluation of USAA insurance. cheapest. At the end of the day, not everyone can get a USAA plan.

While it provides several of the very best rates, it can be a little bit much more pricey than USAA. affordable car insurance. We located that Progressive offered much better cars and truck insurance prices in Florida than in numerous other states. As an additional full-service firm, Progressive has a great deal going for it. The insurer has an AM Ideal economic strength ranking of A+ and also has actually brought brand-new technologies to the vehicle insurance market given that its inception in 1937.

Looking at customer support, Dynamic got on average in both of the studies by J.D. Power pointed out over. While there may be various other companies with much better customer support, we think Modern offers the most effective vehicle insurance for Floridians that aren't qualified for USAA protection. Pros Disadvantages Among the leading auto insurance firms in the United States Typical cases process Superior monetary stamina score Blended consumer service assesses Fantastic option for risky chauffeurs Greater prices than some rivals Easy estimates procedure To find out even more about the vehicle insurance carrier, have a look at our testimonial of Progressive cars and truck insurance coverage.

The Best Guide To Florida Car Insurance Coverage

State Ranch is the biggest automobile insurance company in the United States, covering even more drivers than any various other business. One point that makes this company attract attention is its suite of insurance applications that can make life simpler as well as supply discount rates: This app lets you submit cases, spend for your policies, manage your savings account, as well as more - insurance.

The qualification offers lowered prices for young drivers. This is State Farm's usage-based insurance policy app.

A lot of the State Ranch apps have excellent user scores in the Google Play and also Apple app stores - automobile. Pros Disadvantages Extensive insurance coverage offerings Noted errors with autopay Considerable option of price cuts offered in 48 states Not taking new clients in Massachusetts or Rhode Island Favorable customer testimonials as well as easy online prices quote procedure Greater prices than some competitors Numerous discounts for teenagers and students Superior financial stamina ranking and also A+ score from the BBB You can locate even more info in our State Ranch insurance evaluation.

Vehicle drivers might think that vehicle insurance is economical for Floridians since the responsibility requirements are fairly low contrasted to that of various other states, yet that's incorrect. Florida is actually placed as the fourth-most costly state for auto insurance coverage by the NAIC. Costs can differ relying on your area, driving history, and also extra (trucks).

The Best Guide To This Is The Most Expensive State To Be A New Driver - The ...

Minimum Coverage Requirements For Florida Auto Insurance policy Each state needs citizens to provide evidence that they can take care of the economic responsibility of an automobile mishap. By far, one of the most common method states do this is by calling for vehicle insurance coverage. car. Florida is among those states and has monetary obligation legislations that require every motorist to carry car insurance policy